14/10/2025

Key Insights from HMRC on R&D Tax Credit Statistics 2025

Learn how the Research and Development Tax Credit scheme changes in 2025, and what UK businesses need to claim successfully, with insights from HMRC statistics.

14/10/2025

Learn how the Research and Development Tax Credit scheme changes in 2025, and what UK businesses need to claim successfully, with insights from HMRC statistics.

HM Revenue & Customs (HMRC) has released new figures on the Research and Development Tax Credit scheme. Business leaders can use these statistics to better understand how the UK’s innovation community is being supported with R&D tax relief.

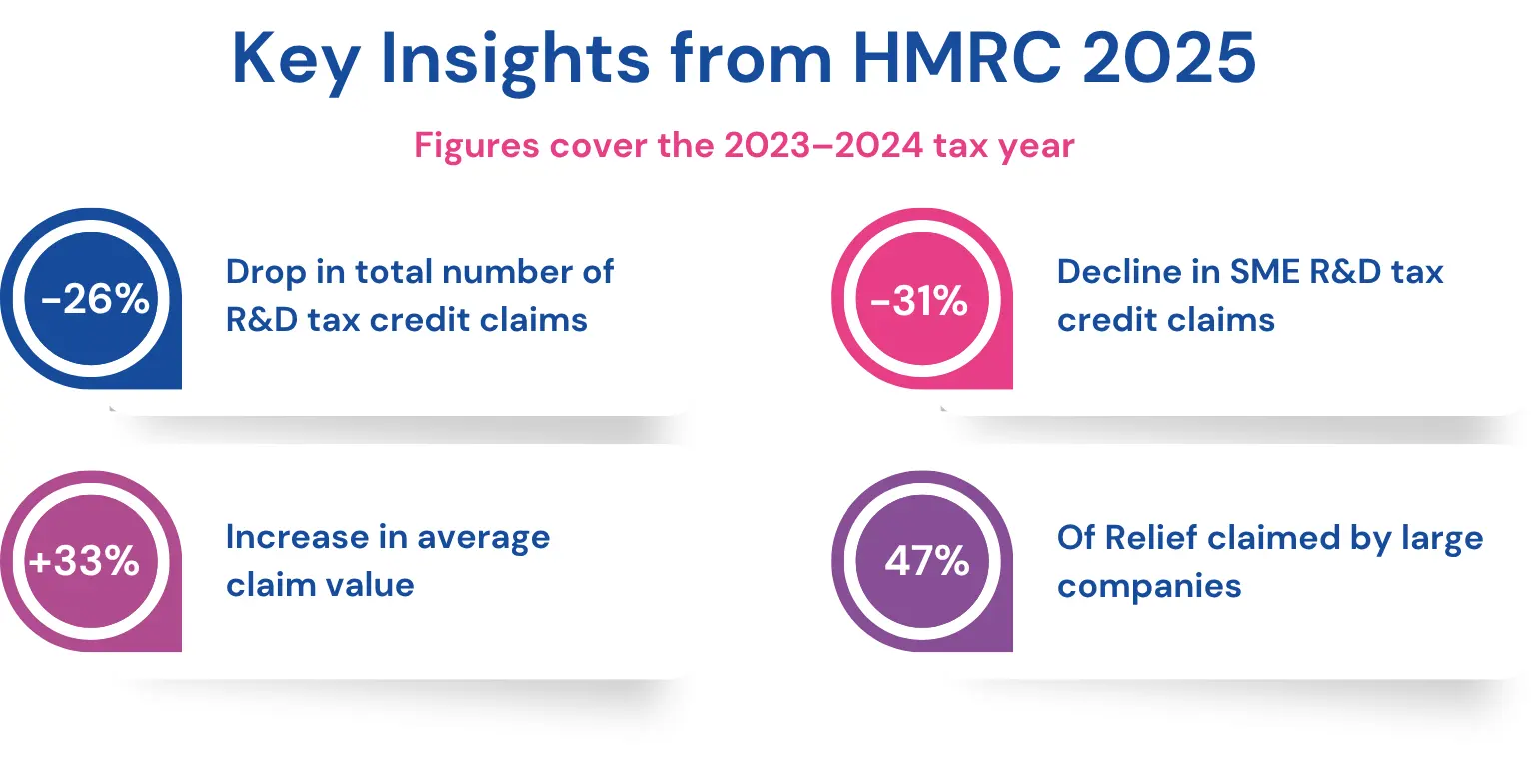

The latest figures, which focus on the 2023 - 2024 tax year, show that smaller numbers of companies are claiming research and development tax credits. However, on average, the claim value has risen sharply.

In particular, larger firms have benefited from higher RDEC rates. However, both RDEC and SME schemes are facing increased complexity and more stringent requirements. In short, these changes show how the R&D tax credit scheme is evolving, rewarding stronger evidence and well-prepared claims.

This article features key takeaways from HMRC’s latest statistics, explaining who is claiming, how much support is being secured, and what can be done to make your next R&D tax credit claim successful.

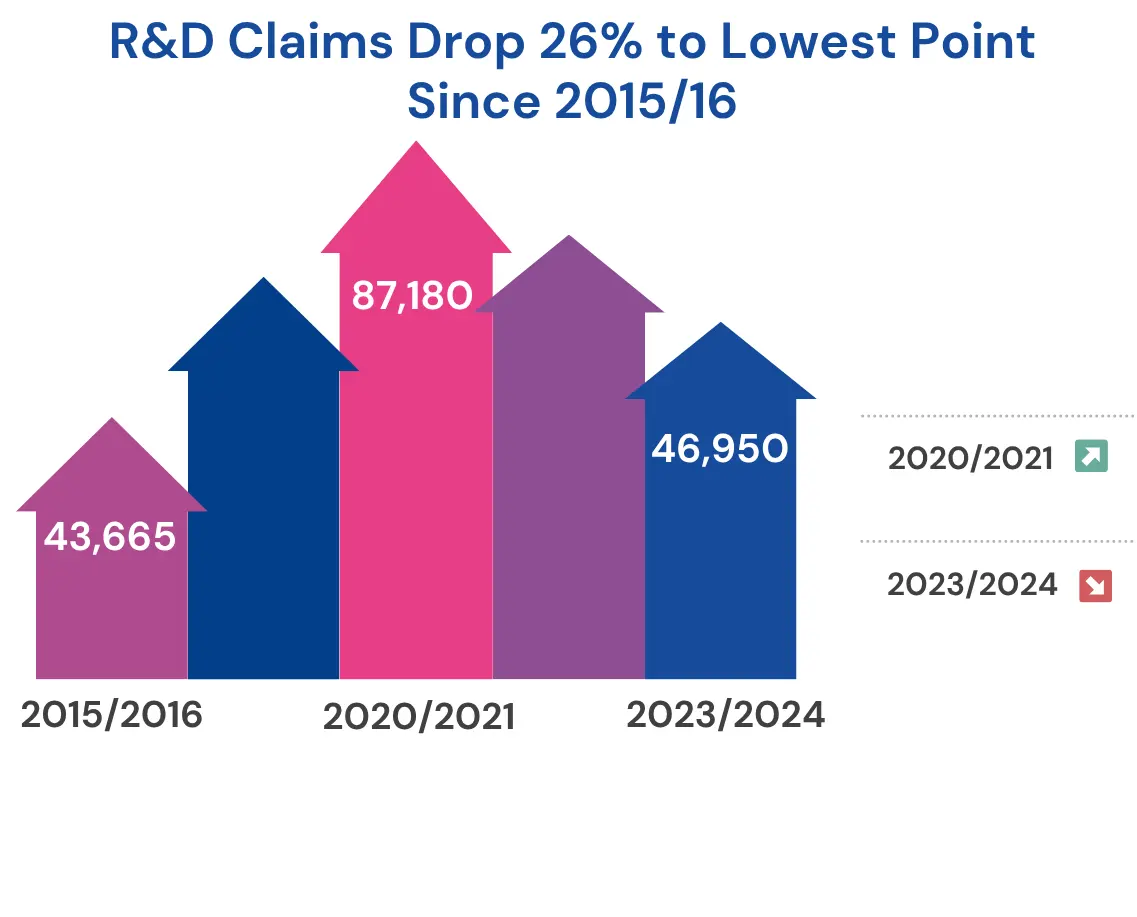

The number of companies claiming research and development tax credits continues to decline. In total, HMRC reports a 26% drop in volume, with the 46,950 claims made across 2023/24 marking the lowest total in almost ten years. The current figure is just 8% above the 43,665 claims reported for 2015/16 and far below the 87,180 reported in 2020/21.

For SMEs, the picture is even bleaker, with the latest data revealing a fall of 31% over the same period. The volume has now dropped for two years running.

In terms of value, overall support provided through R&D tax credits only fell by 2%. The main reason for this is a 33% increase in the average claim size, compared to the previous cycle. As a result, larger claims are capturing a larger portion of the support pool, likely as a result of better evidence and planning.

In summary, bigger projects are being favoured, smaller efforts are coming under pressure, and only the strongest claims that are supported by high quality evidence are delivering the best results.

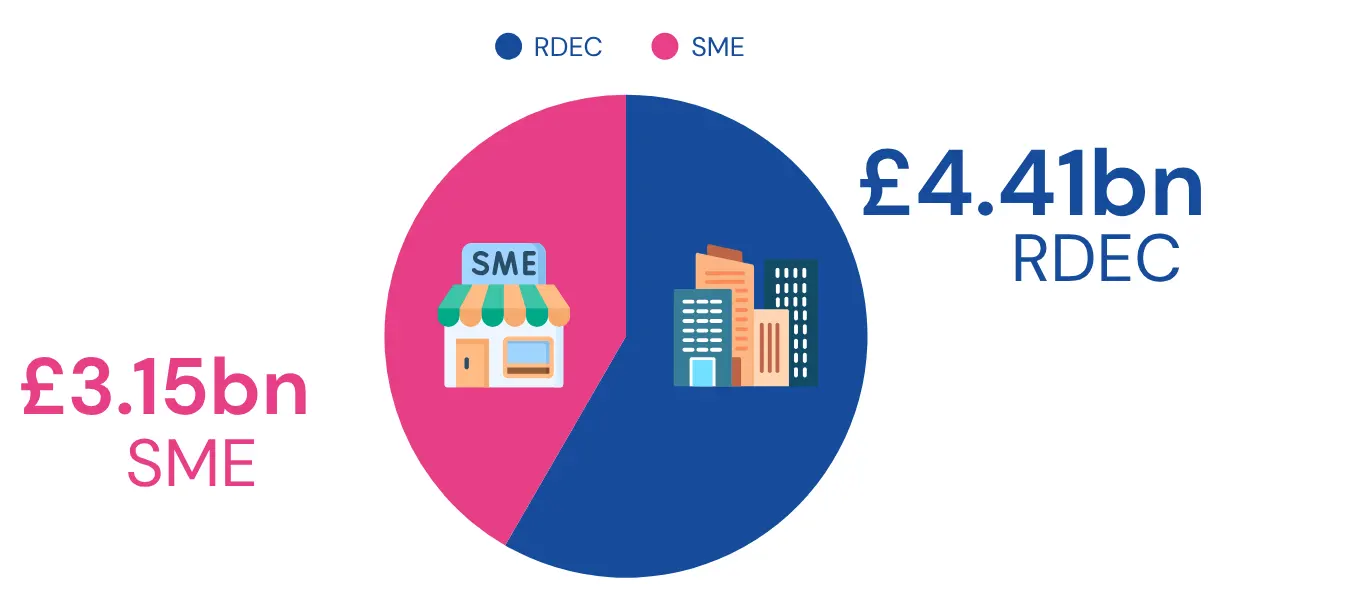

In the 2023 - 2024 tax year, the RDEC scheme, not the SME scheme, saw the most relief awarded. For this period, £4.41 billion was awarded through RDEC claims, in front of £3.15 billion through the SME route.

This switch follows several changes to relief levels over the years. In particular, the SME scheme’s enhancement rate for eligible costs dropped to 86%, while the credit on losses was cut to 10%. Meanwhile, larger and subcontracting companies have seen their RDEC rate move up to 20%.

Larger companies have a strengthened their position in the R&D tax credit ecosystem, now accounting for around 47% of the total relief awarded. In terms of overall volumes, the total number of RDEC claims has dipped by 5%. However, this hides a 12% fall in large company claimants alongside a smaller 2% fall from SMEs claiming through this scheme. Despite the decline in claims, the overall value of RDEC support remained relatively unchanged. The higher credit rate is making bigger and riskier projects more rewarding for these firms, giving them greater confidence to plan, invest and deliver longer-term innovation.

For eligible companies, both schemes can be used to support innovation. However, the approach has changed to now favour larger and better-prepared claims. Easy R&D offers a free pre-claim assessment that can help businesses in all sectors decide which scheme matches their situation and make sure their approach is right from the start.

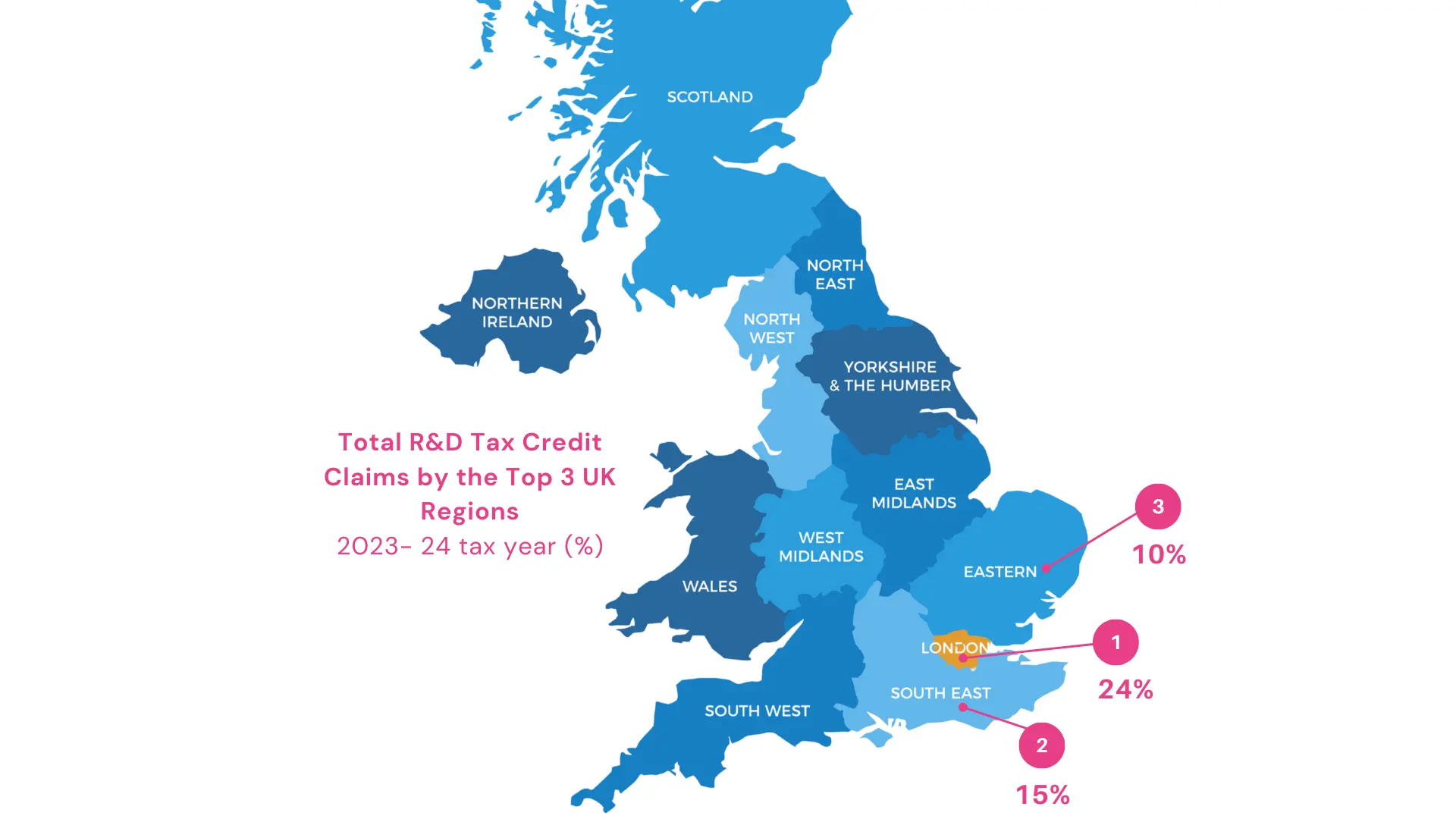

London remains the most active region for Research and Development (R&D) tax credit activity, accounting for 24% of all claims and 31% of the total amount claimed for the 2023 - 2024 tax year. In second and third place, the South East of England and the East of England contributed 15% of claims and 20% of the total value claimed, and 10% of claims and 13% of the total amount claimed, respectively. In total, these three regions account for the majority of R&D tax relief activity across the UK.

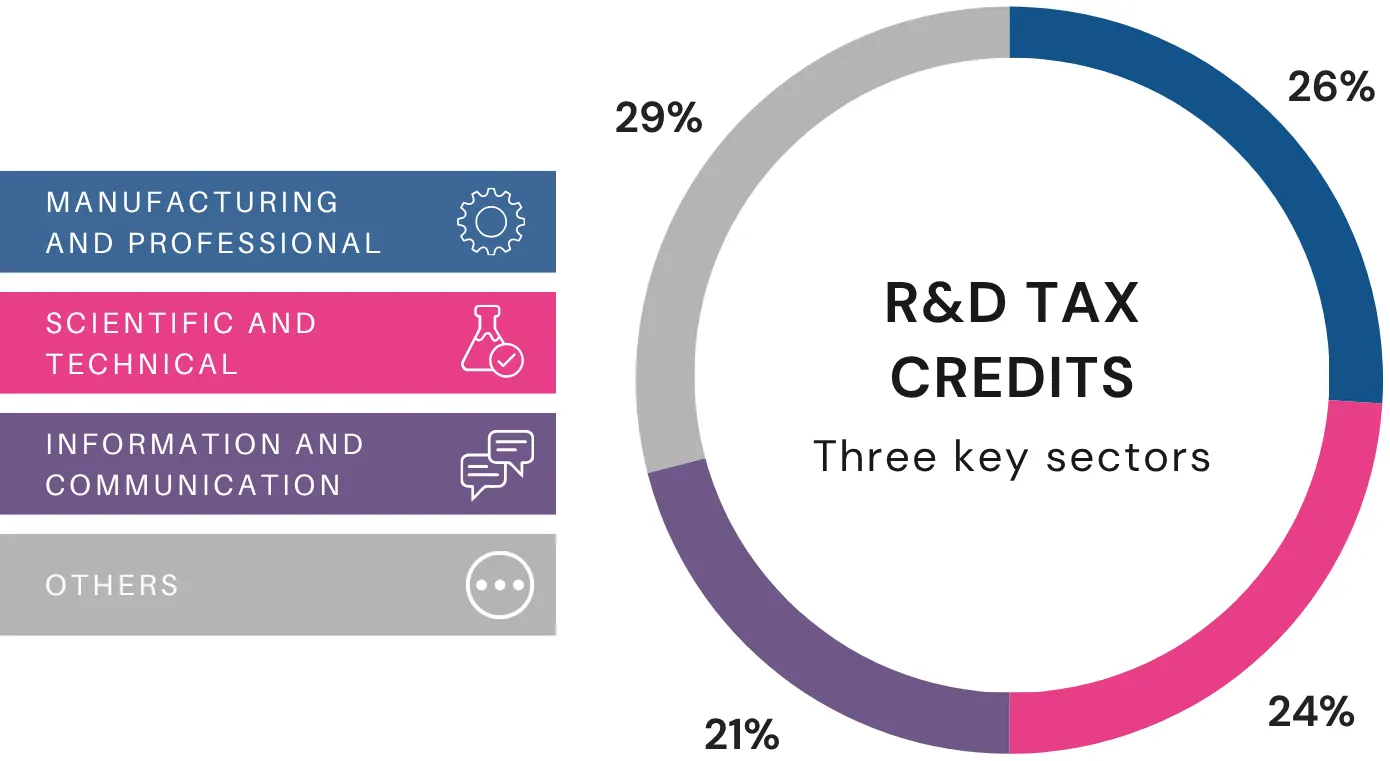

According to HMRC statistics published in 2025, the vast majority of R&D tax relief claims continue to come from the Information & Communication, Manufacturing, and Professional, Scientific & Technical sectors. Much as in previous years, these three innovation intensive industries dominate the landscape, together accounting for a significant proportion of the total R&D tax relief claimed across the UK.

Companies in each region and sector face their own challenges, from the need to track eligible costs in small businesses to stricter reporting rules in technology and manufacturing sectors. Easy R&D’s support includes technical reporting templates that can help clients in all regions and industries prepare their supporting documentation with accuracy before submission, and in ways that satisfy key HMRC expectations.

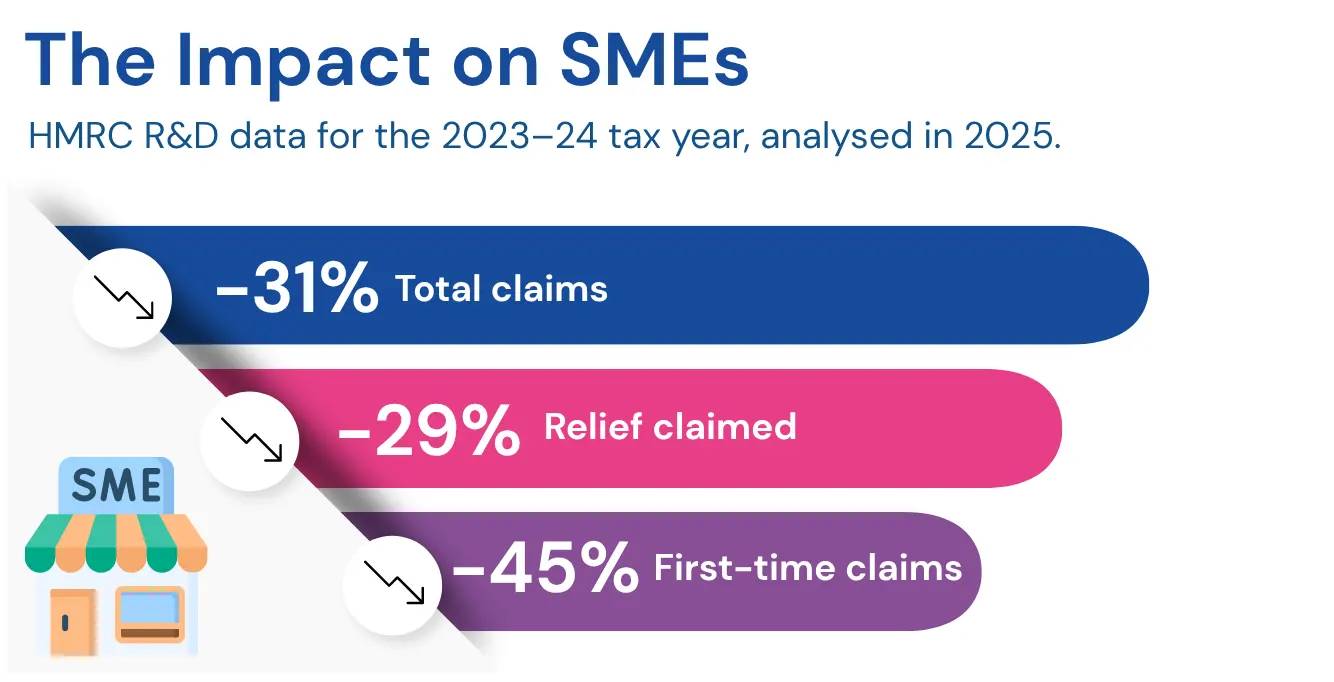

Recent HMRC statistics show just how much of the landscape has changed for smaller and medium-sized businesses.

The impact of HMRC’s stricter rules has been felt mostly by SMEs. They have seen a drop of 31% in the number of claims made, a 29% fall in the total relief claimed, and a 45% decrease in the number of first-time applications. The steepest decline has been in the number of smaller claims under £15,000.

This doesn’t necessarily mean that less innovation is taking place. Instead, it’s likely that greater complexity, from new forms to stricter technical requirements, has made many businesses think twice before taking the plunge and applying.

On the one hand, these measures have been introduced to reduce fraud and improve accuracy. On the other hand, however, they have also made it harder for time-pressured, often cash-strapped SMEs to get involved. The good news is that those who adapt, by preparing early, documenting more clearly and understanding what qualifies, can continue to claim.

Innovation continues to be strong across the UK, and with the right support, SMEs can claim with confidence and help drive progress forward.

At Easy R&D we believe that the lesson for anyone running an innovative project is clear: if it’s real, then it’s supported. The R&D tax credit process is there to shine a light on your work and help you succeed, but the bar for clear evidence and technical proof is now set high for a reason. Here is our advice on how to make your claim count.

This is the standard now, and is especially true for smaller firms who used to make use of the SME scheme. R&D tax credits are rewarding better prepared claims that are built around proof, process and technical honesty.

The message from 2025 is straightforward: claiming relief on casual or hurried projects are unlikely to succeed. HMRC is continuing to back research and development. It is just more targeted at the companies who prepare properly. If you are operating in a sector known for world-leading, ground-breaking work, such as Information & Communication, Manufacturing and Professional, Scientific & Technical sectors, then the opportunity to benefit is as strong as ever.

The vast majority of successful R&D tax credit claimants take the time to build a strong technical case, demonstrate clearly how they are solving a challenging problem and maintain thorough evidence in the event that HMRC may ask to review their claim. With the right mindset and supporting documentation, R&D tax credits can truly shine a light on the value of your company’s innovation and technical progress.

In particular, for SMEs, this period of change should be seen as an opportunity to improve their approach, not as a reason to disengage. The process is more demanding, but it is also fairer and more transparent, rewarding genuine innovation and clear preparation. Smaller firms are often the leaders in creative problem-solving and, with the right support, can continue to access valuable benefits. The key is to plan early, document thoroughly and stay confident in the value of their work.

We help you gather the technical evidence, time records and supporting details HMRC looks for. See how the research and development tax credit scheme could support your next move. Speak to Easy R&D today.

Written by: Laura Velasquez

Marketing Manager focused on Tax Incentives for Innovation

01708 925 641

For more information on how Easy R&D can support your business, please contact us directly.

Get in touchEvery customer and every claim we work with benefits from our deep expertise in how HMRC manages R&D tax credit applications.

If you'd like to learn how R&D Tax Relief could support your business, our team is here to help you.

Stay informed on the latest R&D Tax Relief updates, gain exclusive insights from our experts, and receive industry-specific tips by signing up for Easy R&D’s newsletter.