21/02/2025

Proving Innovation: The Importance of R&D Record-Keeping for HMRC

Keeping accurate R&D records can feel challenging, but it doesn’t have to be. In this article, we’ll show you why good record-keeping matters and how it can make submitting an R&D claim much smoother.

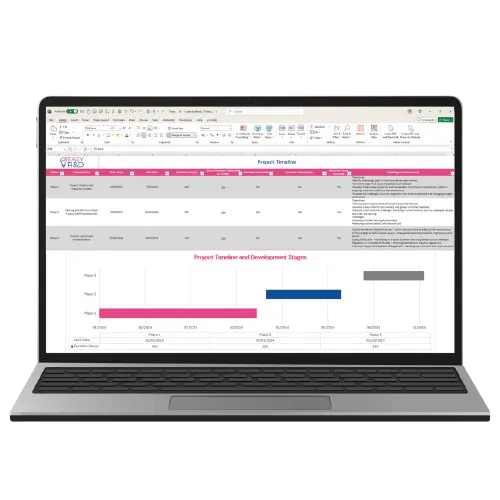

To help, we’re giving you the Project Timeline Template 2025, a clear, structured timeline designed to track every stage of your R&D project and ensure you have all the key details ready when it’s time to submit a claim. Read until the end to download it and start using it right away.