04/11/2025

Tribunal Orders HMRC to disclose its use of AI in R&D Tax Reviews

First-tier Tribunal ordered HMRC to disclose whether it has used AI to assess R&D tax relief claims, marking a key moment for transparency in tax reviews.

04/11/2025

First-tier Tribunal ordered HMRC to disclose whether it has used AI to assess R&D tax relief claims, marking a key moment for transparency in tax reviews.

With compliance reviews increasing, it’s no surprise that businesses have grown more cautious, questioning what really happens behind the scenes. The question “Does HMRC use AI to make decisions?” is not merely technical; it goes to the heart of the way companies prepare, submit and defend their claims, and how HMRC ensures the privacy and security of taxpayer data.

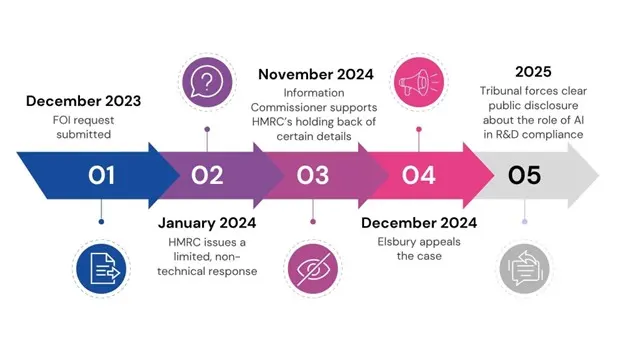

The timeline above illustrates the key milestones from Thomas Elsbury’s FOI request in December 2023 to the tribunal’s 2025 ruling that required HMRC to reveal details about its use of AI in R&D tax compliance.

By the end of 2023, UK businesses had begun to notice a shift in the way HMRC was reviewing R&D tax relief claims. Against that backdrop, consultant Thomas Elsbury submitted a Freedom of Information Act (FoIA) request, asking HMRC to clarify the extent to which its staff were using artificial intelligence (AI) within R&D compliance work.

He also requested details of the safeguards in place to protect taxpayers’ confidential information, and the measures ensuring that decisions were made fairly and transparently.

HMRC refused to disclose this information, arguing that releasing it could compromise its compliance activities and increase the risk of fraud. The response offered little clarity and left many questions unanswered.

Due to the continued lack of transparency, Elsbury escalated the matter to the Information Commissioner’s Office (ICO). Two years after the original request, a tribunal finally overturned the previous decision and ordered HMRC to provide a clear response on the role of AI in its compliance processes.

Judge Alexandra Marks accepted Elsbury’s arguments, setting a deadline of 18 September 2025 for HMRC to issue a definitive statement. By mid-September, HMRC issued its formal response to the tribunal’s order, bringing the two-year process to a close.

Elsbury’s Freedom of Information request in December 2023 set off a careful response from HMRC. By January 2024, HMRC had invoked an exemption to restrict technical details, aiming to protect the integrity of their tax investigations. However, the matter did not rest there.

After a ruling in November from the Information Commissioner that supported HMRC’s position, Elsbury appealed. The Tribunal stepped in and demanded a clear answer on whether HMRC uses AI to make decisions about R&D tax relief.

By mid-2025, during the Tribunal hearing, R&D tax advisers pointed out unusual details in HMRC’s compliance letters; things that didn’t quite fit the usual tone or style. Some letters showed signs of American spellings, odd punctuation such as the “long dash”, and even phrases that didn’t make much sense in context.

Thomas Elsbury argued that these quirks were more than coincidence. He suggested they might indicate that parts of HMRC’s correspondence were being drafted or influenced by AI, raising questions about accuracy, consistency and data privacy.

What started as a narrow dispute over information access had, by this stage, become a broader debate about transparency. Businesses and advisers wanted clarity not only on the way in which HMRC reviewed claims, but also on whether technology was quietly shaping decisions that could affect R&D tax claims.

Following the tribunal’s order, HMRC issued its formal response in September 2025, confirming that no generative AI is used by the R&D Tax Relief Compliance Team. All correspondence is drafted and reviewed by human caseworkers, and no automated letters are sent to businesses. According to industry reports, including the Financial Times, any technology handling claim data is limited to internal support functions such as fraud detection or risk profiling, with a complete ban on AI-generated assessments or communications.

While HMRC stated that “this technology was not approved for use in generating taxpayer letters”, two separate advisers told the Financial Times that, despite the lack of an approved policy, some individual caseworkers had used AI tools when drafting correspondence for R&D tax relief claims.

According to the Financial Times, one person told them that “a number of people” were disciplined in 2023 for using AI in preparing responses, within HMRC’s Individuals & Small Business Compliance Directorate, the team responsible for most R&D claims. Another insider said that “they’re not using it now”, adding that the discovery led HMRC to introduce AI-use training for staff.

These revelations suggest that, even if official policy forbids AI-generated communications, isolated use may have occurred, raising further questions about transparency and consistency in HMRC’s compliance approach.

Although HMRC eventually issued its response, stating that it does not use artificial intelligence to make decisions on R&D tax relief claims, no evidence or detailed explanation was provided to illustrate the way the review process actually operates in practice. This lack of clarity has left many advisers and businesses feeling that a degree of opacity still remains in the way claims are assessed and selected for review.

Industry experts have said that, while the use of technology to detect potential fraud is understandable, HMRC’s response seemed to divert attention from the core question of how AI has been used in practice. Some have suggested that the department has not been fully transparent, with communication that risks appearing defensive or incomplete.

In response, HMRC stated that: “Where risks are identified, an enquiry is opened by a human who checks those claims, maintains customer contact throughout and makes the final decisions on that enquiry” and that “any staff found misusing AI would face disciplinary action”.

At Easy R&D, we believe that trust between the tax authority and businesses can only be built through open and consistent communication. Transparency should not arrive as the result of legal pressure, but as a natural feature of a modern, fair, and accountable tax system.

The message for claimants remains the same. High-quality technical records, clear narratives about uncertainty, and cost evidence give every claim its best shot at a smooth review. With these foundations in place, businesses can continue driving innovation, knowing their submissions will be judged fairly and by a skilled eye.

If you’re unsure about the impact of AI on your R&D tax relief claim, our specialists are here to help. We’ll guide you through the evolving compliance environment, strengthen your documentation, and ensure your claim is well-prepared and fully compliant. Speak to our team today for a free consultation and approach your next submission with confidence.

Written by: Laura Velasquez

Marketing Manager focused on Tax Incentives for Innovation

01708 925 641

For more information on how Easy R&D can support your business, please contact us directly.

Get in touchEvery customer and every claim we work with benefits from our deep expertise in how HMRC manages R&D tax credit applications.

If you'd like to learn how R&D Tax Relief could support your business, our team is here to help you.

Stay informed on the latest R&D Tax Relief updates, gain exclusive insights from our experts, and receive industry-specific tips by signing up for Easy R&D’s newsletter.