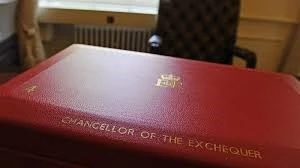

Autumn Statement 2022: What it Means for R&D Tax Relief

In the aftermath of the latest November 2022 budget statement, we now know more about Jeremy Hunt’s approach to R&D tax relief. Having digested the statement and worked with our tax experts to assess the impacts on our customers and the future values of R&D claims, I remain optimistic.