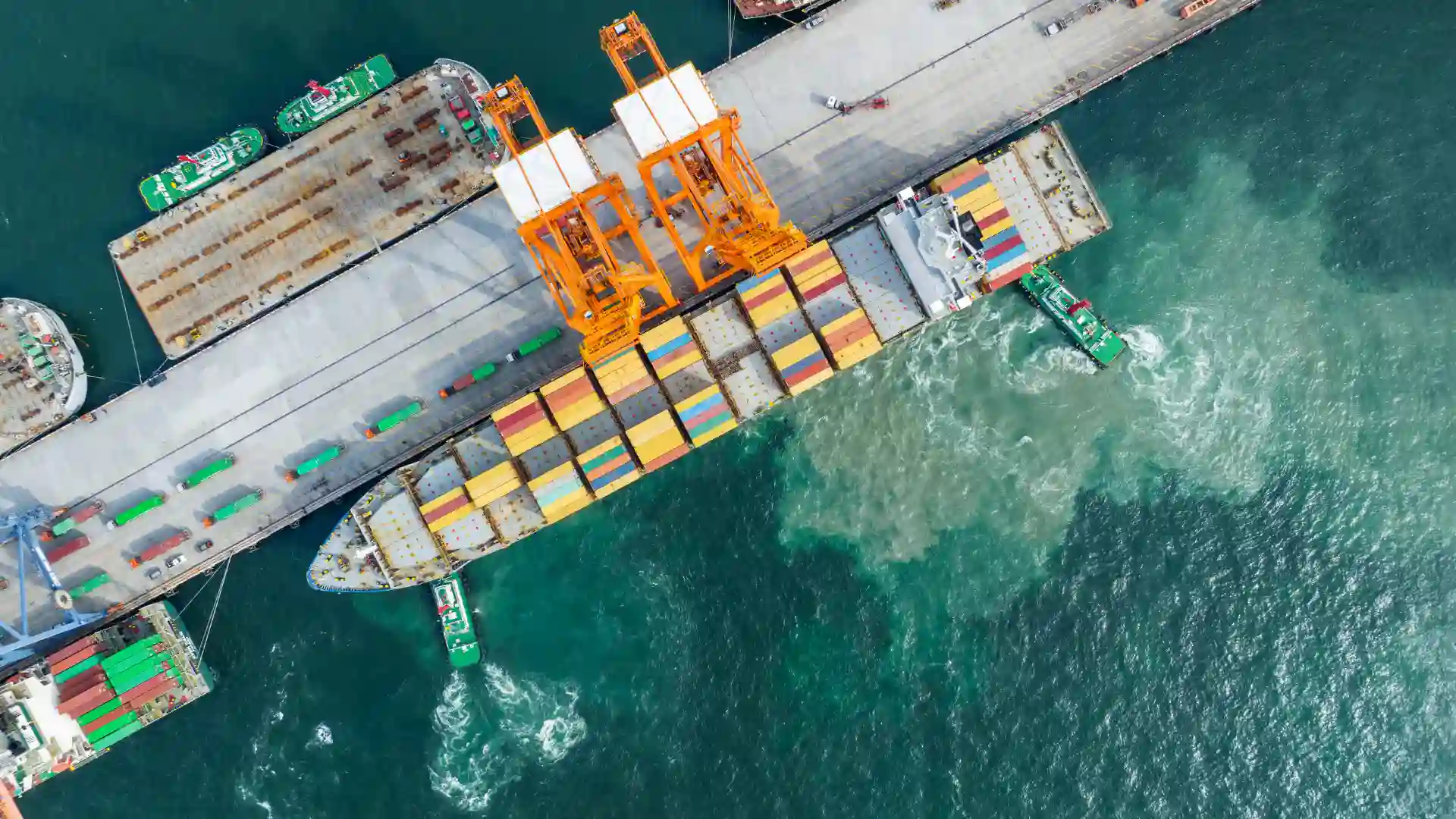

MARINE / MARITIME

National Maritime Partnership Easy R&D Innovation Support

MARINE / MARITIME

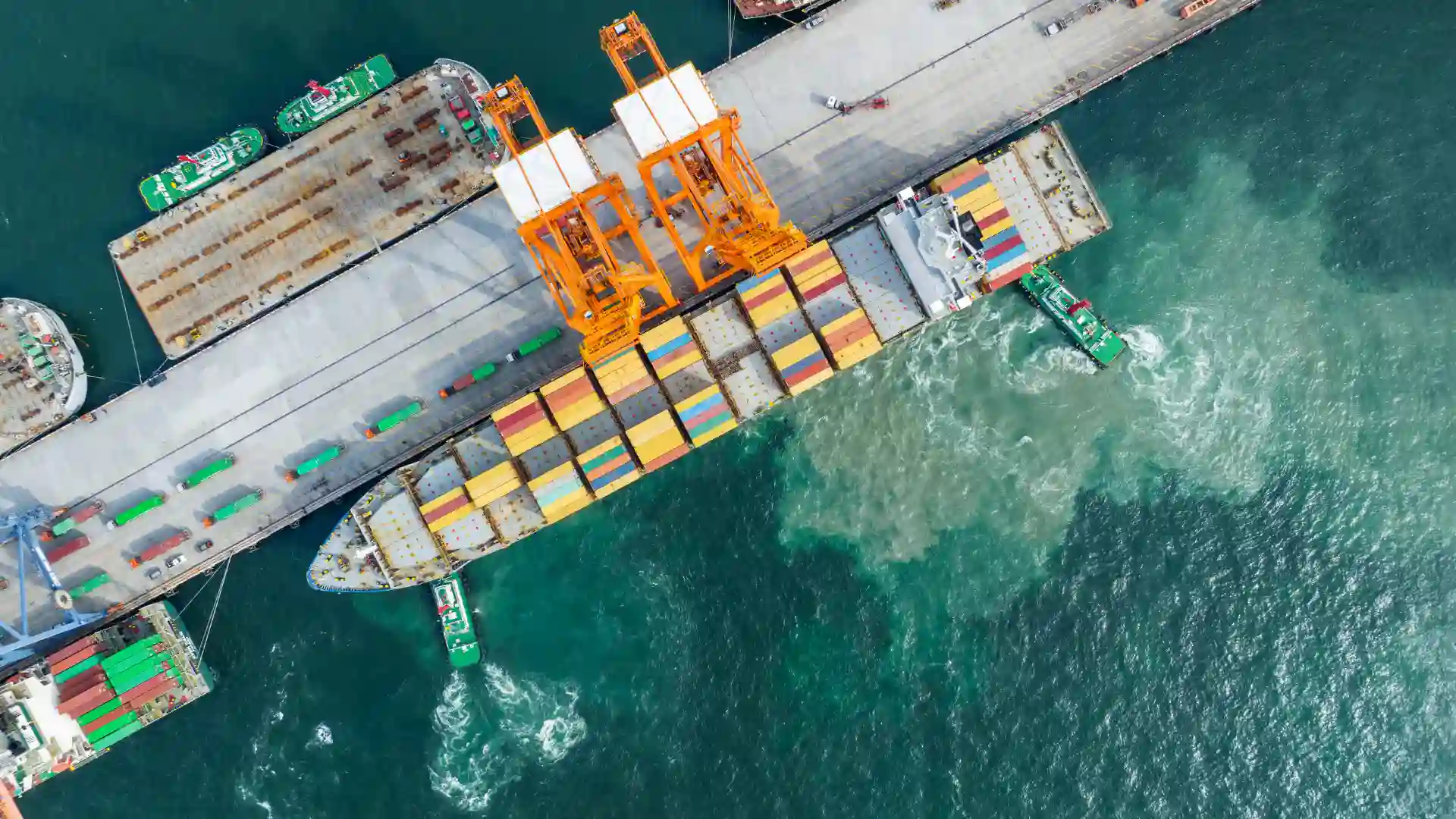

Easy R&D is proud to be the exclusive R&D tax relief partner for National Maritime (NMDG), one of the UK's leading maritime networks. This strategic partnership brings our specialist tax relief expertise to a sector renowned for its commitment to innovation, sustainability, and industry growth. Explore our live funding options on National Maritime’s site here.

Our collaboration ensures dedicated support for maritime businesses across the UK by helping them access a variety of tax reliefs. R&D tax relief is a business positive, flagship scheme enabling qualifying companies to reduce their corporation tax bill, employ more staff or continue to invest in pioneering research and development initiatives. You may already be carrying out activities that qualify under the scheme.

A testament to the value of this collaboration is our recent engagement with Marine Zero, an innovative company committed to reducing environmental impact through zero-emission solutions in maritime transport. We had the pleasure of connecting with Marine Zero through our attendance at SOCSEA24. We are working closely with Marine Zero to explore R&D funding opportunities that align with their goals for innovation and environmental stewardship. Learn more about Marine Zero here.

Our partnership with NMDG provided the opportunity to attend SOCSEA24, a significant event focused on developing a sustainable blue economy and featured two main stages:

SOCSEA24 allowed us to connect with forward-thinking maritime companies committed to a sustainable future, whilst strengthening our ability to engage with industry leaders to discuss the benefits of R&D tax relief for transformative projects within the sector.

If you know of businesses that need funding, share our free eligibility assessment tool. This quick assessment can help determine if their business qualifies for the government’s R&D tax relief scheme, making it easier to access resources that support growth and innovation.

For more information on how Easy R&D can support your business, please contact us directly.

Get in touchYour client base can be a source of new and ongoing value with our Easy R&D trusted partner programme.

Since 2014, we’ve partnered with professional services firms across the UK, extending the range of specialist Tax Relief services that they offer. Our partnership proposition is built around our expert consultants, skilled report writers, Skilled report writers, ATT and CTA-qualified tax team, and a dedicated, friendly customer support staff.

If you'd like to learn how R&D Tax Relief could support your business, our team is here to help you.

Stay informed on the latest R&D Tax Relief updates, gain exclusive insights from our experts, and receive industry-specific tips by signing up for Easy R&D’s newsletter.